Sephora and Ulta are typically jam-packed with shoppers adding richly-pigmented red lipsticks, lightweight foundations, and shimmery eyeshadows to their totes — gleaming from excitement as they test new products in stores. Now, during COVID-19, the only item shoppers can test is a bottle of hand sanitizer outside of the limited-capacity makeup showroom.

“I saw a definite decrease, actually a complete halt, to my in-person clients back in March, April, and May of 2020,” said Jennifer Duvall, Georgia-based professional makeup artist. “I had pretty much zero in-person business, which was 100% pandemic-related because everything was unknown.”

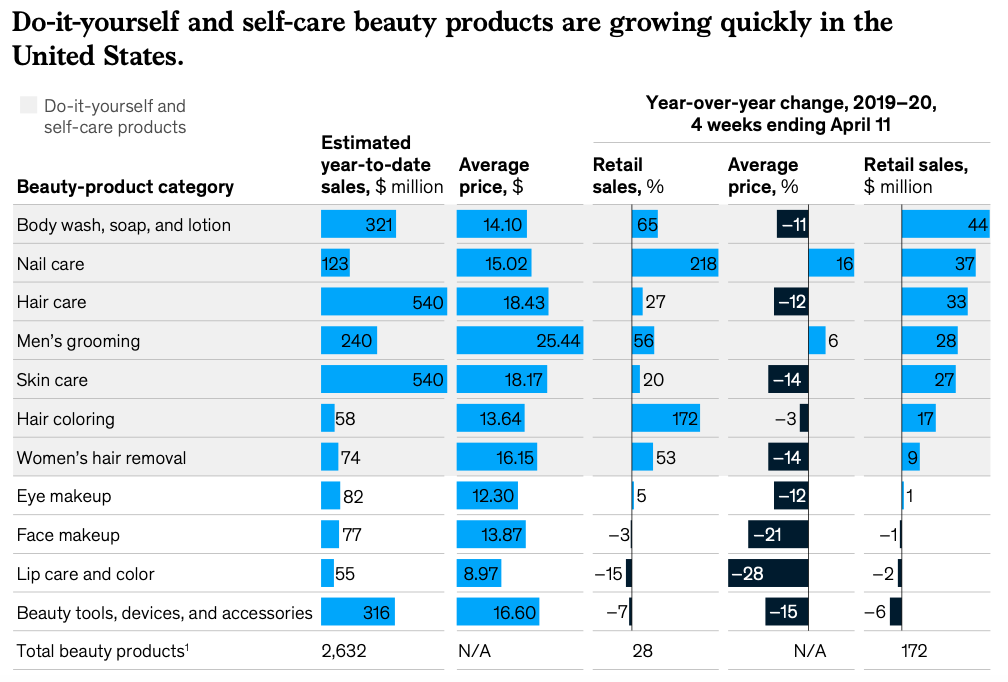

More recently, spending on beauty products reached a 97% decline in February 2021 and has remanded and continues to plummet into the “red zone,” as conceptualized by IRI’s CPG Demand Index. What’s more, global beauty sales for face products have decreased by 21% in 2020, while lip product revenue slid down 28% — likely due to mask-wearing.

“I saw a definite decrease, actually a complete halt, to my in-person clients back in March, April, and May of 2020,” said Jennifer Duvall, Georgia-based professional makeup artist. “I had pretty much zero in-person business, which was 100% pandemic-related because everything was unknown.”

More recently, spending on beauty products reached a 97% decline in February 2021 and has remanded and continues to plummet into the “red zone,” as conceptualized by IRI’s CPG Demand Index. What’s more, global beauty sales for face products have decreased by 21% in 2020, while lip product revenue slid down 28% — likely due to mask-wearing.

“The traffic seems to be picking back up at Sephora and Ulta but it doesn’t seem to be as crowded as it was before March of last year,” Duvall added. “When I’m in larger stores like Target, however, the beauty aisle is a popular place to be.”

Interestingly, the removal of in-person testers makes this qualitative response much more interesting. Target, one of America's favorite retailers that sells everything from baby diapers to over-the-counter medications, doesn't offer in-store product testers. Target sells drugstore makeup brands like Covergirl, Maybelline, and NYX Cosmetics and, for drugstore brands, product testing isn't an option — even at Ulta which, unlike Sephora, sells these affordable makeup brands.

Duvall said that while she safely enters beauty counters to swatch and look at products, most of her makeup shopping has been online. The whole kid-in-a-candy-store feeling may be on the backburner, but that isn’t the case for skincare sales, which have surpassed makeup revenue for the first time ever during the pandemic, according to The New York Times.

Interestingly, the removal of in-person testers makes this qualitative response much more interesting. Target, one of America's favorite retailers that sells everything from baby diapers to over-the-counter medications, doesn't offer in-store product testers. Target sells drugstore makeup brands like Covergirl, Maybelline, and NYX Cosmetics and, for drugstore brands, product testing isn't an option — even at Ulta which, unlike Sephora, sells these affordable makeup brands.

Duvall said that while she safely enters beauty counters to swatch and look at products, most of her makeup shopping has been online. The whole kid-in-a-candy-store feeling may be on the backburner, but that isn’t the case for skincare sales, which have surpassed makeup revenue for the first time ever during the pandemic, according to The New York Times.

|

This is likely due the COVID-19 coming-of-age skin condition, “maskne”: a form of “acne mechanica” in which moisture develops from mask friction and leads to enlarged pores and breakouts. Moisturizers, serums, and treatments have been on the rise, as well as eye makeup — a sultry wing eyeliner completes the mask-wearing look when bold lipstick can’t.

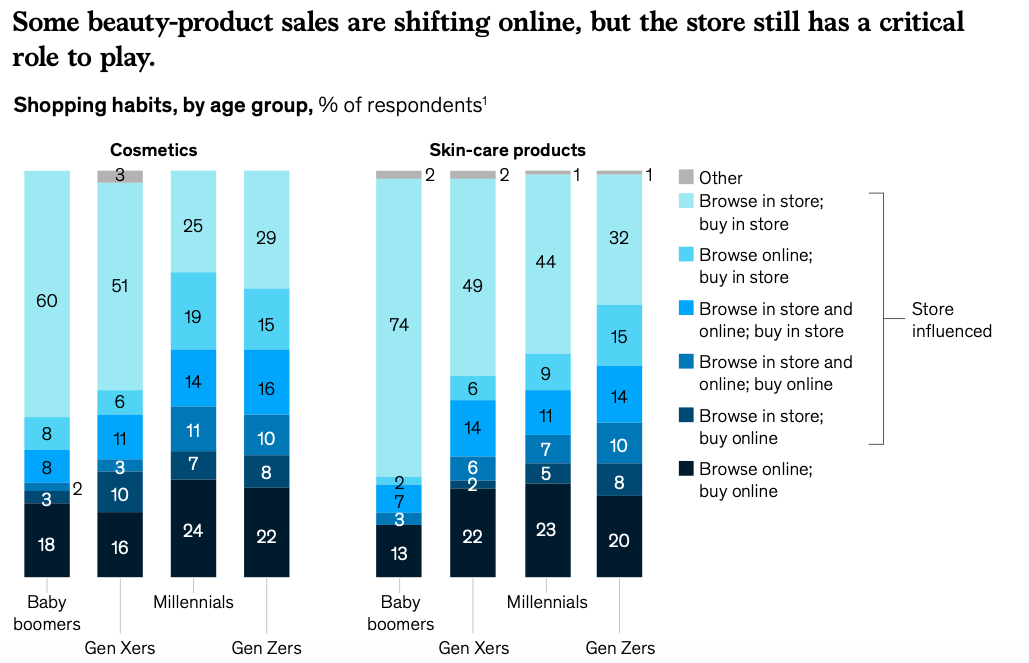

According to market data from McKinsey & Company, consumers who browse and buy makeup products online has risen among the baby boomer, millennial, Gen Z, and Gen X generations. For skincare products, it's more common for consumers to wear a mask, walk into Sephora, and consult a beauty expert to ensure what ingredients (i.e. caffeine, retinol) work best for their skin types. As a beauty writer at Insider who has spoken to many dermatologists and experts in the field, I've learned that makeup purchases are often hybrid (a mix of in-person and online buying), so much so that Sephora has a "shade finder" on its website to help consumers find their perfect shade without visiting their local retailer. For instance, if a savvy Sephora shopper swears by their Clinique foundation, and they simply input that specific shade, that shopper can purchase the sister shade of another brand. |

"I have done quite a bit more of online buying now, due to ease, and to reorder products I often use and are familiar with," Duvall said. "But it's still worth it for me to go in-store to look around and see new products with my own eyes because it's difficult to purchase some makeup items without seeing them in person."

And, while errand runners can compromise living without their favorite lipstick for a while, there’s one category of people who can’t: brides having a “COVID wedding.”

“Brides are more focused on smaller gatherings and, even if they can’t have as many people attend their weddings, they certainly want to be able to share their photographs from their special day with those who couldn’t be there — which means they still want to look best in their photos,” Duvall said. “Now, my business is actually better than ever: people are getting headshots done for new online businesses they’re launching, brides are feeling safe to come back, and my in-person makeup lessons are picking back up."

The beauty industry certainly has its prime times and low points, but it’s prevailing. To make things efficient, the beauty industry has developed more subscription-based and at-home makeup kits within personal care inventories. Body washes, nail care, and hair care have surged in sales, though makeup has been on and off.

And, while errand runners can compromise living without their favorite lipstick for a while, there’s one category of people who can’t: brides having a “COVID wedding.”

“Brides are more focused on smaller gatherings and, even if they can’t have as many people attend their weddings, they certainly want to be able to share their photographs from their special day with those who couldn’t be there — which means they still want to look best in their photos,” Duvall said. “Now, my business is actually better than ever: people are getting headshots done for new online businesses they’re launching, brides are feeling safe to come back, and my in-person makeup lessons are picking back up."

The beauty industry certainly has its prime times and low points, but it’s prevailing. To make things efficient, the beauty industry has developed more subscription-based and at-home makeup kits within personal care inventories. Body washes, nail care, and hair care have surged in sales, though makeup has been on and off.

Let's break down the data. The above beauty statistics from McKinsey & Company showcase (1) different product categories (i.e. body wash, soap, and lotion; eye makeup; beauty tools, devices, and accessories), (2) estimated year-to-date sales in millions, (3) the average price of products in each category, (4) the percentage of retail sales, (5) fluctuations in price, and (6) retail sales in millions.

The most interesting aspect of this data pertains to the all-time-high percentage of retail sales for nail care and hair coloring. Though the above data from McKinsey & Company reflects the rise of do-it-yourself products in general, COVID-19 has a direct impact on consumer spending models with restrictions on nail and hair salon appointments. While these kinds of service shops are on their way to reopening in the summer of 2021, there is a heightened "risk of exposure," according to Professor Donald Shaffner of Rutgers University-New Brunswick's School of Environmental and Biological Sciences.

Moreover, a July 2020 report by the CDC showed that two hairstylists in Missouri exposed more than 100 clients to potential illness. The good news: because they were fully masked, 67 clients tested negative for SARS-CoV-2 — the face-covering policy helping to mitigate the spread of COVID-19.

So, in terms of McKinsey & Company data, people who are of high risk — like adults 65 and older and caregivers watching and exposed to young children — benefit from these do-it-yourself hair and nail kits. Not to mention, self-care has been scientifically proven to improve well-being and lower mortality and healthcare costs, according to a 2019 study published in ScienceDirect.

“I have no doubt the beauty industry as a whole will bounce back very soon,” Duvall said. “Women want to feel confident in the way they carry themselves and, putting time into their appearance — like applying skincare and makeup products — is an act of self-care, self-respect, and self-expression.”

The most interesting aspect of this data pertains to the all-time-high percentage of retail sales for nail care and hair coloring. Though the above data from McKinsey & Company reflects the rise of do-it-yourself products in general, COVID-19 has a direct impact on consumer spending models with restrictions on nail and hair salon appointments. While these kinds of service shops are on their way to reopening in the summer of 2021, there is a heightened "risk of exposure," according to Professor Donald Shaffner of Rutgers University-New Brunswick's School of Environmental and Biological Sciences.

Moreover, a July 2020 report by the CDC showed that two hairstylists in Missouri exposed more than 100 clients to potential illness. The good news: because they were fully masked, 67 clients tested negative for SARS-CoV-2 — the face-covering policy helping to mitigate the spread of COVID-19.

So, in terms of McKinsey & Company data, people who are of high risk — like adults 65 and older and caregivers watching and exposed to young children — benefit from these do-it-yourself hair and nail kits. Not to mention, self-care has been scientifically proven to improve well-being and lower mortality and healthcare costs, according to a 2019 study published in ScienceDirect.

“I have no doubt the beauty industry as a whole will bounce back very soon,” Duvall said. “Women want to feel confident in the way they carry themselves and, putting time into their appearance — like applying skincare and makeup products — is an act of self-care, self-respect, and self-expression.”